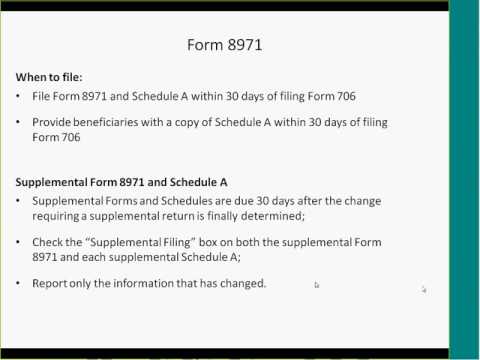

Good morning, everyone. As this screen indicates, we're going to be covering for MIDI 971. Firstly, we're going to be covering 4971 and how the Console Riders One Source Trusted Administration 706 program allows you to prepare for maybe 971. The first thing I want to do is review the rules and just keep it fresh so you understand why the program works the way it does. So, let's start with how you can ask questions. There are two ways to do this. You can click the chat button on the top of your screen and type your questions in the chat dialog that opens up. Make sure to send your questions to Charles Rosslyn. Alternatively, you can click the participants button and click the "raise hand" button to ask your question directly. I'll unmute you so you can ask your question. Let's get started. Who is required to file form 89 71? Any executor who is required under section 60 18 to file form 706. This means that whether or not there's a tax liability, the gross estate exceeds the basic exclusion amount. The exclusion amount was $5,450,000 in 2016, $5,430,000 in 2015, and is reduced by the sum of any post 1976 gifts and any specific exemption allowed after September 1976. In addition, if you meet the first requirement and file the return after July 31, 2015, you must file an 89 71. It doesn't matter when the return is due; what matters is when it's filed. There are times when you're not required to file a return but may do so. In those instances, you're not required to file form 89 71 either. This includes estates not required to file a 706 but do so for the sole purpose of making a portability election, making a GST...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 1041 Qft Processing