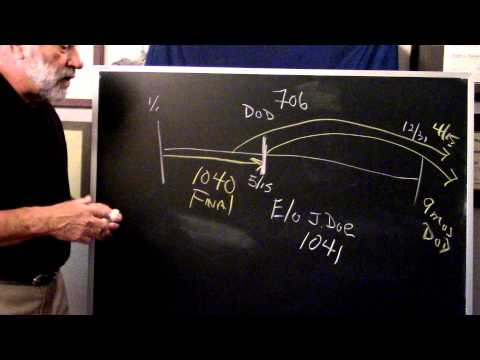

Hello, I'm Doctor Palumbo. In this video, I'd like to discuss the tax returns that might be required when a person passes away. Now, I know from my years of public practice and teaching taxes that this is an area that not only confuses accounting students, but everyday people as well. So, what is it that I need to file? We're going to talk about that today. I found that by using a little schematic on the board, it helps people understand the whole idea. Hopefully, a light bulb will go off in your head as well. So, without any further discussion, let's go to the board. I hope you can all see the board clearly. The first thing I'd like to do when talking about taxes is to set up a little timeline on our calendar year. January 1st is the start of the year and December 31st is the end of the year. Now, let's say we have a person named John Doe. John Doe is going along in life, but unfortunately, he passes away on May 15th. This date becomes the date of death. On the date of death, a couple of things happen. First of all, John Doe ceases to exist and a new entity called the estate of John Doe is formed. The first thing we need to consider is whether or not the estate is eligible or required to file an estate tax return. The estate tax return is a form 706. This form takes into account all the assets, subtracts liabilities, and calculates the tax based on the person's worth at the time of death. For 2015, the exemption amount is $5,430,000. This means that not many people would be required to pay estate taxes. However, it's still important to check if they have a farm,...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 1041 Qft Decedent